- March 31, 2025

- May 30, 2025

- September 30, 2025

- November 28, 2025

Property Taxes

Property taxes are levied by the Municipality. Taxes provide the main source of revenue to deliver services supplied by the Municipality, County and School Boards.

The interim tax bill is an estimate to raise approximately fifty percent (50%) of your previous year's property taxes. When the current year's budget for the Municipality of Brockton has been approved and the Province of Ontario provides us with an education tax rate, the final tax bills are issued. The amount of the interim bill is deducted from your final tax bill.

How is Property Tax Calculated?

Properties are assigned a tax class depending on the use or purpose of each property. The annual tax rates are set according to the annual budget and applied to each tax class. The tax levy is calculated by using the applicable tax rate and the assessed value of each property; to learn more about how your property taxes are calculated watch the 'How Property Tax is Calculated' video.

There is an annual waste management fee added for each household (including each unit in an apartment building). This waste management fee will be added to the final tax bill and this amount is designated to offset capital expenditures at the Landfill sites that are used by each household.

The 2024 budget contains $20.5 million in operating expenditures and $5.8 million in capital expenditures. After revenues and reserve fund transfers are applied, the Municipality must levy $12,531,038; a 6.41% tax rate increase over 2023. This levy increase will assist the Municipality in maintaining current levels of service while planning for the future, including the increasing demands on our roads infrastructure.

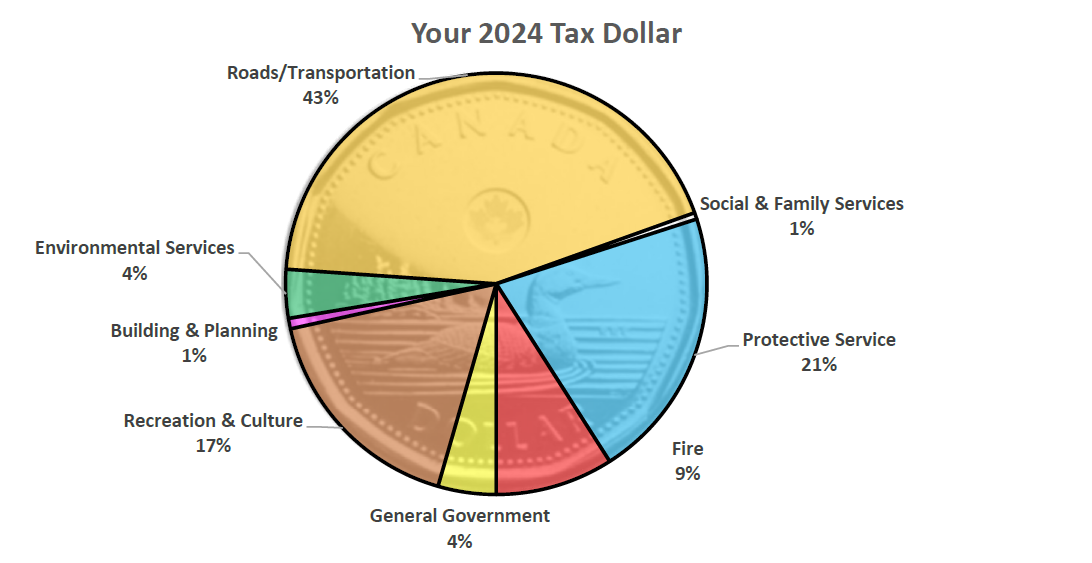

Through the direction of Council, tax dollars are put into action to serve residents and help our community prosper. Have you ever wondered how each tax dollar is spent? The image below shows the 2024 budget broken down into different functions. As you will see, there is a lot more to the budget than just roads and bridges.

Household Waste Management Fee on Taxes

Each household in Brockton is charged an annual Waste Management Fee. This fee is applied to the Final Property Tax Bill and was started in 2012 for all residential properties. The funds collected through this fee are set aside in a reserve fund to deal with costs related to future landfill closure and capital expenditures. These fees do not offset waste collection or disposal costs in the current operating budget.

To assist with this process, waste diversion will extend the lifespan of the landfills and is the best opportunity for residents to actively participate in keeping our landfills.

If you own a multi-residential building and your third party waste hauler or collector does not dispose of waste in Municipality of Brockton landfills, you can apply for an exemption to the Waste Management Fee.

To apply for an exemption, please complete the following form and submit it to the Municipal Office: Waste Management Fee Exemption Form.

Often, after a final billing a mortgage company will re-adjust the tax payment portion of the mortgage to account for either a surplus or deficit in your mortgage tax account. We would like to remind you that this adjustment is not necessarily always because your property tax has increased or decreased from the previous year but simply, for various reasons, because the mortgage company was not originally collecting enough on a monthly basis or too much on a monthly basis.

If you have questions with respect to the tax adjustment on your mortgage account it is always a good idea to contact your mortgage company first, they should be able to provide the primary cause behind any payment adjustments.

Contact Us

Municipality of Brockton

100 Scott Street, P.O. Box 68,

Walkerton, Ontario N0G 2V0, Canada

Phone: 519-881-2223,

Toll Free: 1-877-885-8084,

Fax: 519-881-2991

Sign up to our Newsletter

Stay up to date on the Municipality's activities, events, programs and operations by subscribing to our eNewsletters.